ABOUT MINHANG

闽航电子 · 陶瓷电子元器件生产制造商

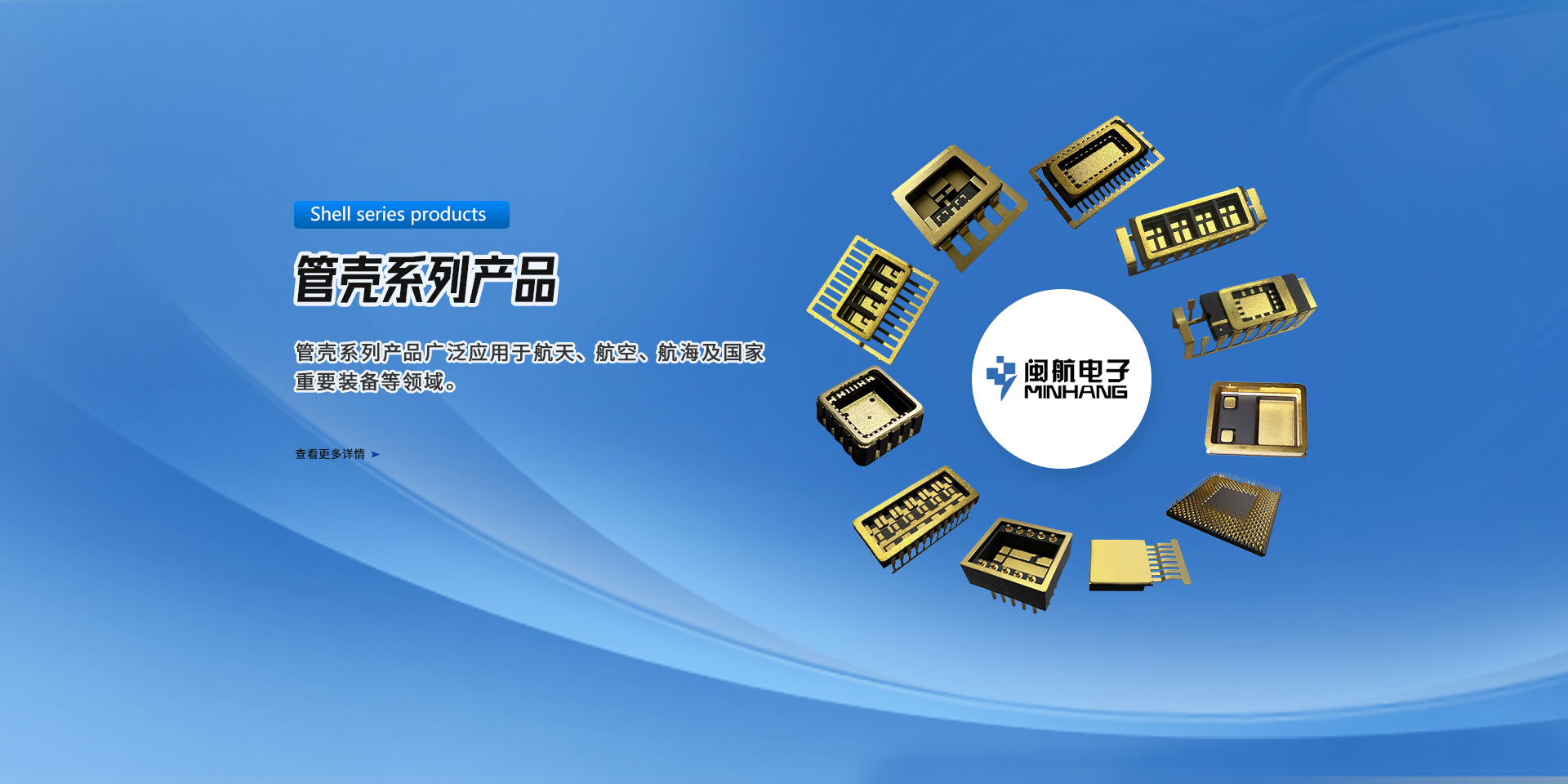

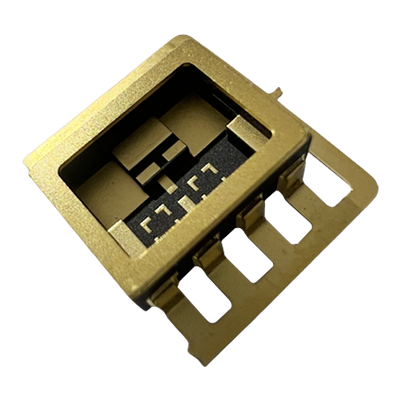

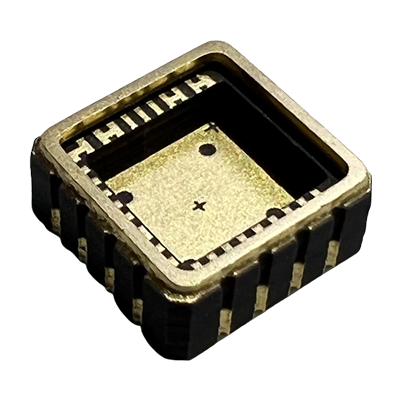

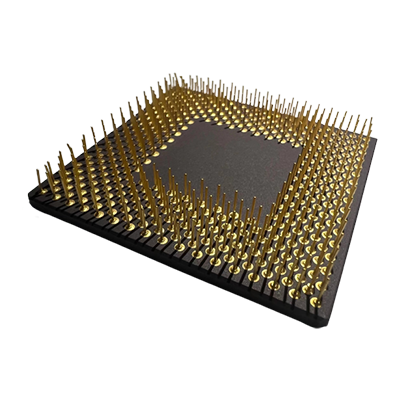

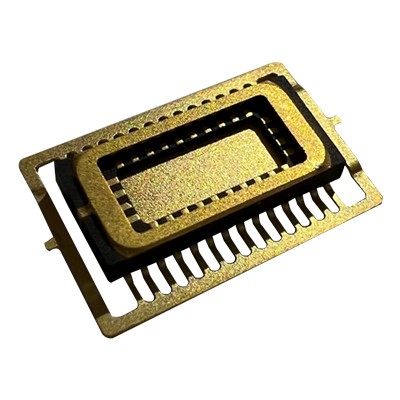

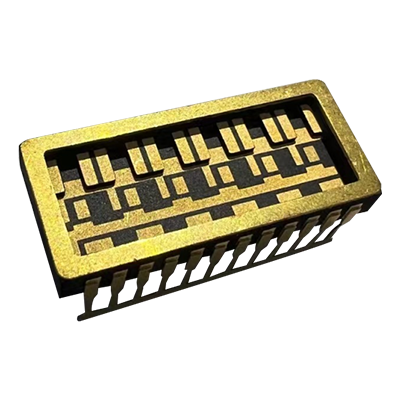

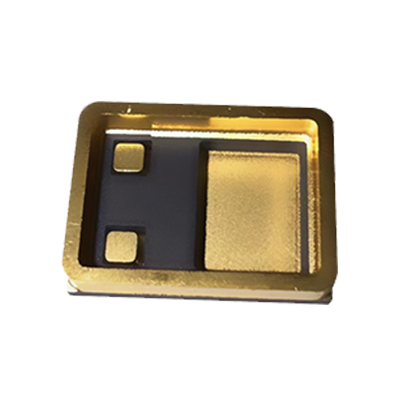

特码官方网站-特码(中国), 是我国专业研制和生产集成电路陶瓷封装外壳的重点企业,是国家级的大规模集成电路高密度封装国家重点工业性试验基地,已有40多年的历史,是我国陶瓷外壳生产单位装备比较先进、开发能力较强、产品质量较好的重点企业之一,能研制和生产CLCC、CQFP、CQFJ、CPGA、CDFN、CQFN、CSOP、CDIP、CSIP、CFP和MCM等系列近百种集成电路陶瓷封装外壳。

经验丰富

闽航电子已有40多年的历史,是我国陶瓷外壳生产单位装备比较先进、开发能力较强、产品质量较好的重点企业之一。

产品种类多样

能研制和生产CLCC、CQFP、CQFJ、CPGA、CDFN、CQFN、CSOP、CDIP、CSIP、CFP和MCM等系列近百种集成电路陶瓷封装外壳。

资质认证

公司通过了用标准GJB9001C-2017、装备质量体系 认证、装备承制注册证、三级保密资格单位、民用标准GB/T 19001-2008、ISO9001: 2008质量体系认证、美国UL认证等。

科技创新

近年来,公司依靠科技进步,以引智为动力,不断引进新技术,新工艺和新管理模式,使企业步入了发展的快车道。

INDUSTRY FIELD

应用领域

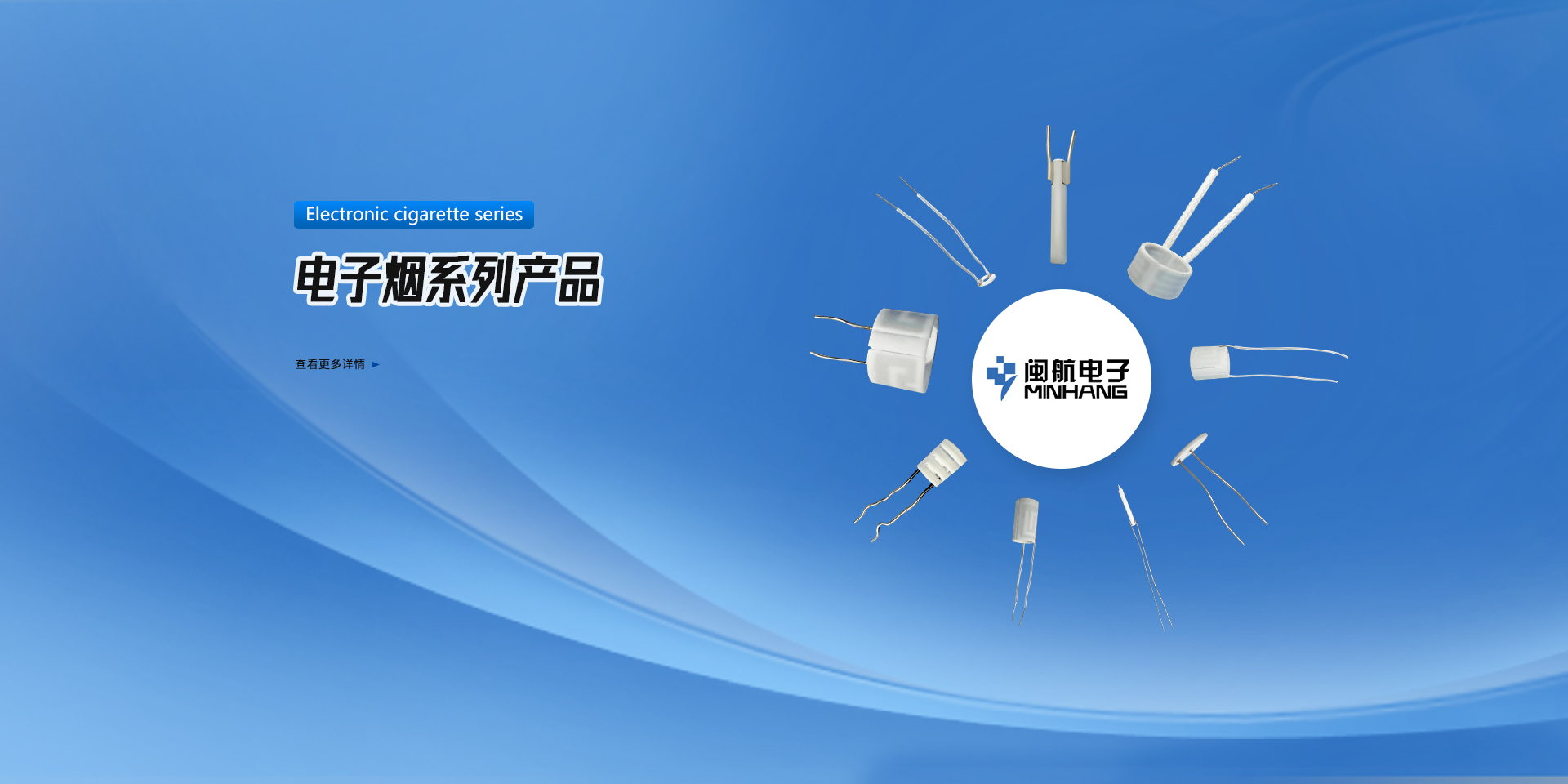

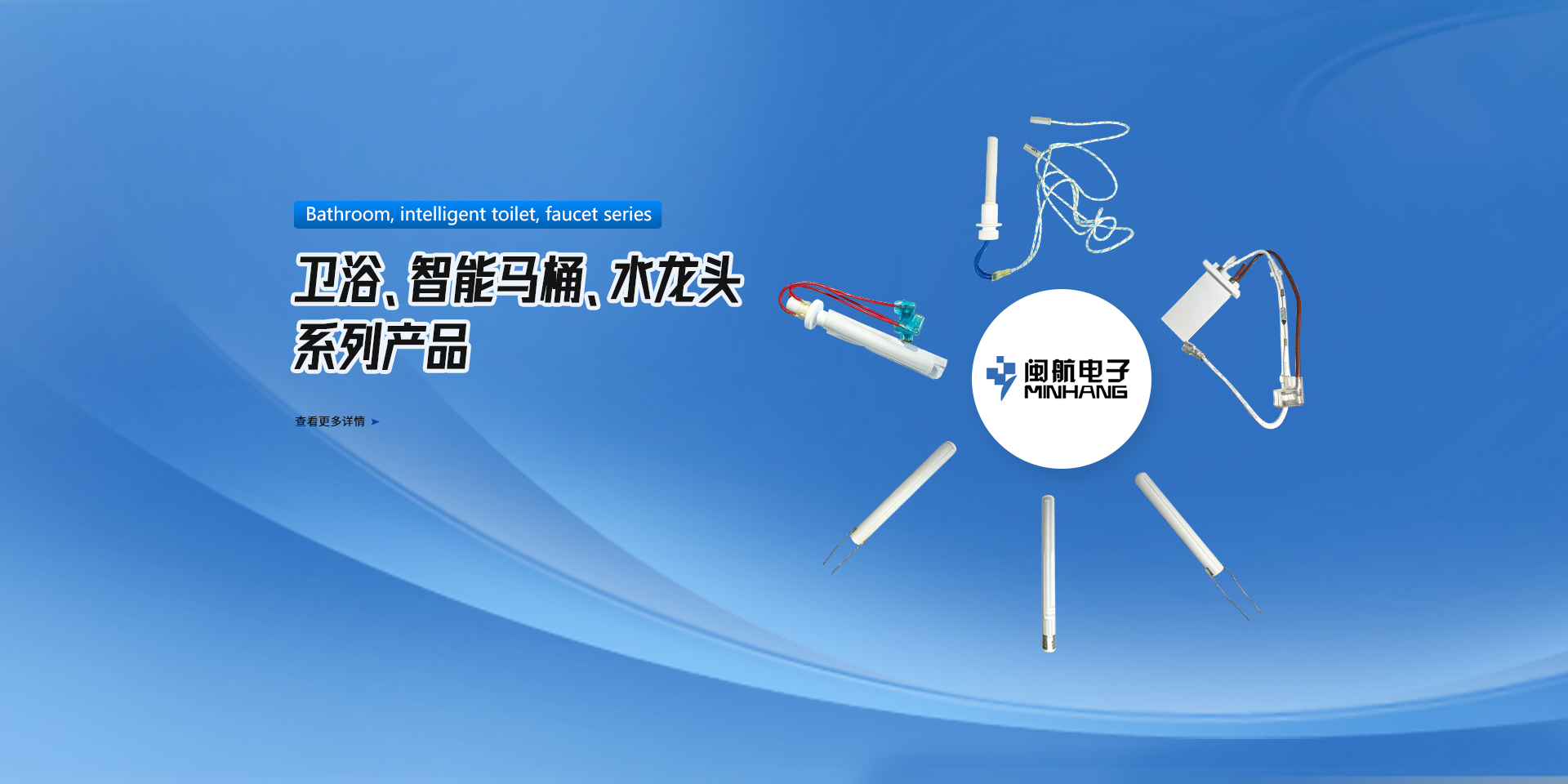

公司贯彻党中央提出的“产品为本,民品兴业”的战略方针, 按照“新工艺、高起点、自动化、上规模”的思路,利用产品技 术平台,借助国外先进技术和管理,加大力度开发民品产品陶瓷 发热体的研发、生产,目前也成为国内主要生产陶瓷发热体的生产厂家,产品广泛应用于智卫浴、工业、医疗、家电、电烙铁、 电子烟等,在国家的民品领域也做出了较大的贡献。

卫浴

工业

医疗

家电

电烙铁

电子烟

军工

航天

LATEST NEWS

闽航资讯

官方公众号

闽航电子 · 陶瓷电子元器件生产制造商

特码官方网站-特码(中国), 是我国专业研制和生产集成电路陶瓷封装外壳的重点企业,是国家级的大规模集成电路高密度封装国家重点工业性试验基地。

Copyright © 2023 特码官方网站-特码(中国), 版权所有 闽ICP备05032656号-1 Powered by saa